Understanding Simple Interest

Your loan is a simple interest loan. When you make a payment, a portion of it goes to interest, and the rest goes to principal. Interest is the rate that’s charged for the use of a lender’s money.

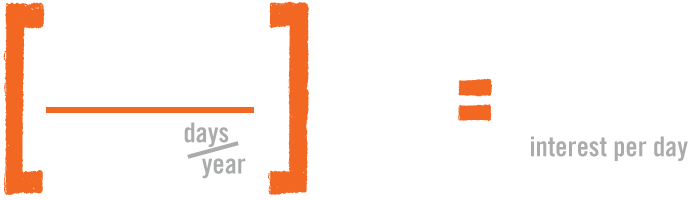

Interest accrues daily on your principal balance amount and is paid from payment to payment or from payment to payoff. If, for example, your loan is for $20,000, and your interest rate is 10%, your interest is calculated according to this formula:

However, if you make your payments on time, your per-day interest rate decreases. So, using our example, the $5.48 daily interest rate would decrease to $1.23 per day after five years.

The amount shown on your statement is the principal balance only. Any interest accrued, outstanding fees or returned payments won’t be reflected on the principal balance showing on your statement.

The amount of interest that is taken out of each payment depends on how many days have elapsed between payments. Your loan may be paid off at any time, and the interest stops the day the payoff is received.

See your contract for interest rates and other details regarding payments.